7 mistakes (or 7 critical success factors) for Successful Succession

- Begin with the end in mind – good strategy takes time.

Business Owners that begin early get a better result – every time. A typical business succession and exit will take at least 18 months and usually 3-5 years to get the best results. Succession planning is about getting three things right at the same time – the business needs to be ready for succession or exit, the finances – both the business and the owners/families need to be set up for retirement or the next stage, and finally, the owners (both exiting and entering) need to be ready – retirement is a significant change. Due to Role Identity Fusion, researchers describe exit as one of the three most emotionally traumatic events for a baby boomer – death, divorce and exit!

- Know where you are starting from – It all begins with Insights.

Most business owners that we deal with are mainly unaware of the actual value of their business. Some underestimate the dollar value; others have wildly high expectations of what the business should be worth; both are traps. Understanding the dollar amount and the key value drivers for your business is one of the most critical success factors. Before you begin the journey to successful Succession or exit, you must know precisely where you are starting from – what is the business worth? What are the key risk elements? What drives value? Which levers can you pull to make the most impact on the outcome?

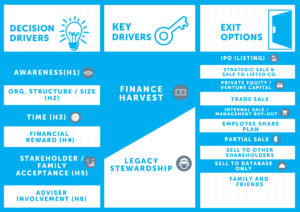

- Understand your exit goal – financial harvest or legacy – or can it be both?

There has been a substantial change in focus for most business owners as they approach exit and retirement – it used to be vitally important to sell the business for maximum dollars to fund retirement, and whilst all of us are pretty happy to extract value from the business we have built over many years it is often no longer the primary focus. Many baby boomers are already quite wealthy, and far more emphasis now on legacy-type outcomes. In other words, they are saying things like I want the business to continue after I exit, I want my employees to be looked after, I want to make sure my clients continue to be serviced well. The diagram below explains the relationship between financial harvest and legacy and how some exit options can perhaps deliver both.

- Business succession and exit planning is a process, not a transaction.

Having worked with over 700 clients over the last 12 years, I have a clear view that the level of success is directly related to how willing the client is to work through the process. We have designed a 21-step process to maximise business value and achieve a successful exit. Clients who follow this process step-by-step over an extended period always get a better outcome. Those looking for a short-term fix or a magic pill outcome typically fail and ultimately start again and therefore take longer.

- It’s all about value – Equity value.

As business owners, we often get caught up in the day-to-day, and there is so much to do just to keep up to date with the various rules and regulations that apply to us that we often have little time to work actively on the business itself. At the same time, our news cycle has become shorter and our attention span weaker – we are often looking at very short-term goals and outcomes – this month’s sales, this quarter’s profit and this year’s performance against budget. To be successful, we have to focus on the value of both our business’s value today and the value we can build over an extended time as part of our overall strategy. Our 21-step process includes five stages, and all are focused on value – identify value, protect value, maximise value, extract value and finally manage value. This requires a much longer decision-making focus and goalsetting time frame – where is your business in 2031?

- Strategic Value – Who and how you sell is the #1 factor

Every business has strategic value; identifying and working out how to maximise it before an exit is also a critical success factor. In many businesses, the strategic value sits within intangible assets – intellectual property, industrial know-how, patents, and trademarks – the secret source of your business is actually where the value lies. Unfortunately, most owners don’t understand this, don’t document this properly and don’t protect the intellectual property assets within their business. These assets are nearly always more valuable within a more significant business. As a result, many large businesses are actively looking for acquisitions that can add strategic value to their own business – they will always pay more, but they are also fussy buyers.

- People are key, key people even more so

Four of our 21 steps are in some way related to people, either reducing key person risk within the business, creating a culture of engagement and ownership mindset, introducing an employee share ownership plan to attract, retain and motivate our key people or designing a management succession strategy to make sure there is a clear pathway for progression and an obvious choice to handover control – if you want to retire or exit someone else must be ready to run the business in your absence. These components also make the business far less risky and, therefore, far more valuable.

The summary version – start early, begin with the end in mind, focus on the long-term outcome and get good advice – maximising the value of your business and achieving a successful outcome is not a DIY project.

Craig West is the CEO of Succession Plus, a boutique advisory firm specialising in business succession and exit planning. In addition to earning some of the industry’s highest awards, he is also the author of ‘Enjoy It’, a business succession and exit planning guide for small and medium business owners. Craig received the Doctor of Business Administration award for his research thesis titled “Examination of the key factors driving business exit options in Australian Small and Medium Enterprises” in 2022. Craig is passionate about encouraging business owners to think strategically, maximise the value of their business and achieve a successful exit.